AugurMax Asset Allocation Changes 2024-03-31

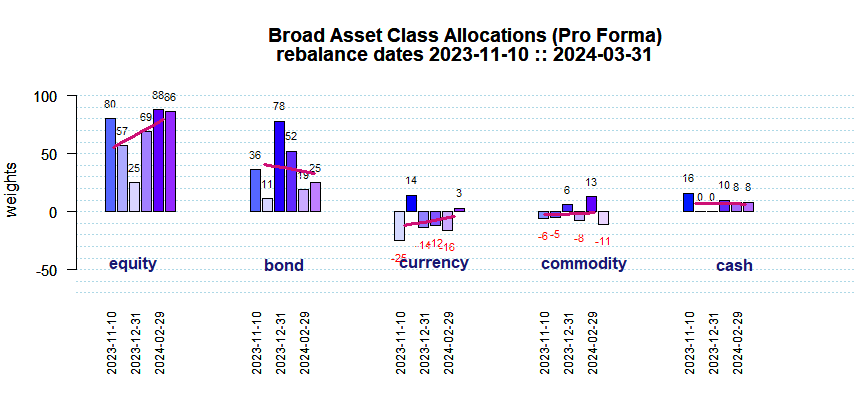

Equity exposure was pushed down marginally after stocks moved up yet again in March. Stocks remain the largest broad asset class and are above their longer term average weighting. Bond exposures increased but are below their long-term average weighting. There was a jump in Currency exposure such that it is now a long suggesting the dollar will weaken. Commodity exposure went negative. Commodities are a bit below their long term average weighting.

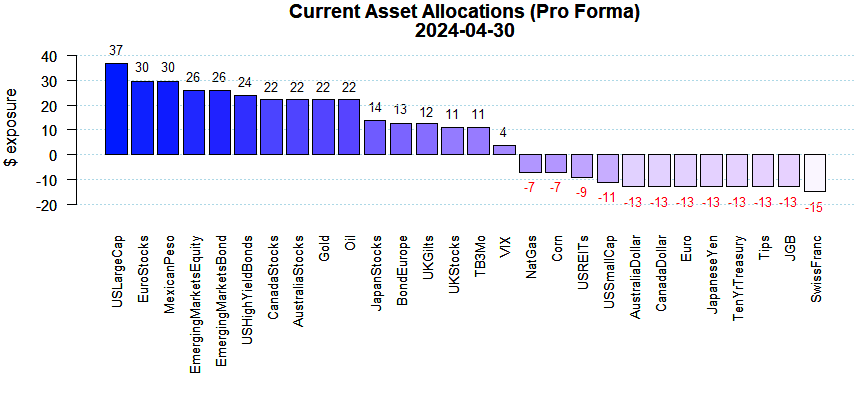

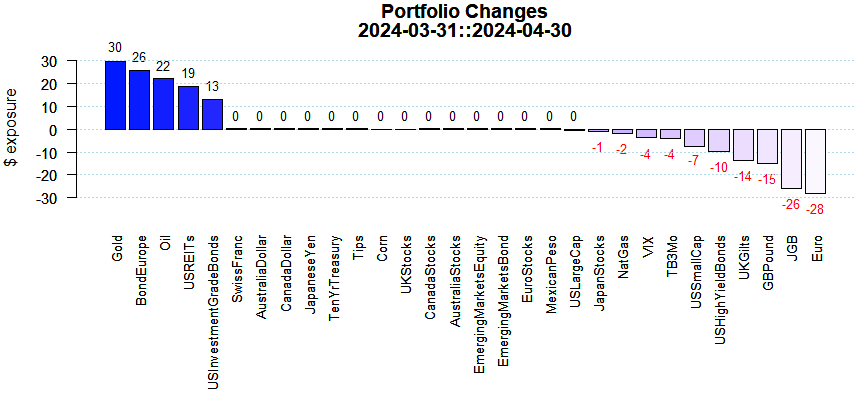

Additional Equity exposures were concentrated in US Large Caps, Euroland, Canada, and Australia. US Small Cap stocks were cut back along with Japanese stocks. The VIX exposure was moved up slightly so its positive weight essentially reduces equity exposure. US REITs were essentially unchanged.

Bond exposures were raised in the UK. JGBs and Emerging Market Bonds were lowered. Cash exposure was unchanged.

Commodities moved down a fair amount and reductions were concentrated in Corn and Gold.

The aggregate positive Currency exposure (indirectly) implies that US rates will be lower relative to the rest of world in the short term. The Mexican Peso exposure is the largest and the Swiss Franc is the smallest.

Stocks jumped in March but equity investors shifted their focus towards value names in energy and utilities and away from growthier tech names. Bonds around the globe were mixed as the stock-bond correlation remained weak. US Tips outperformed US Treasuries showing inflationary fears are still relevant (see breakeven inflation rates). US Large Caps are now 50% above their October lows (see worst drawdowns) with March’s gain adding to that recovery. The prescribed changes are largely influenced by our ECO methodology. Performance results (on a stand-alone basis) for assets like Gold and others using our ECO metrics are shown here.