Bubbles, crashes, rallies, and corrections

Fundamental, cyclical, and emotional factors influence financial markets and can be observed in market prices. Over various time frames, prices can exhibit non-random behavior such as trending, mean-reversion, or bubbles. These price patterns arise in all global markets and can be exploited profitably given adequate liquidity.

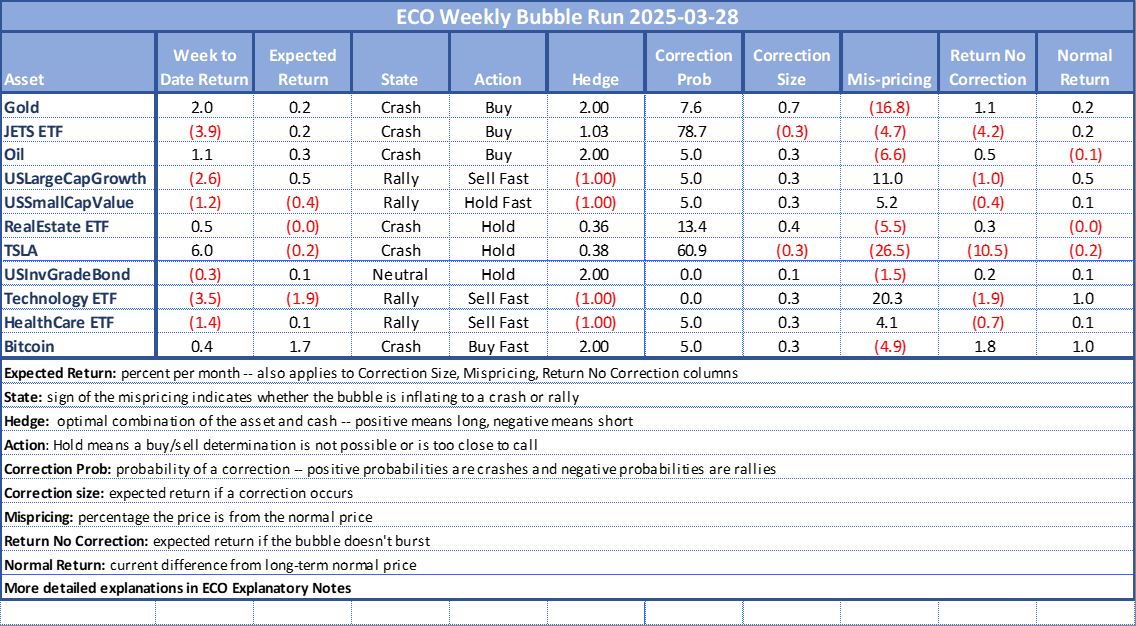

But price patterns are transitory and poorly understood by most discretionary investors. The Efficient Crashes Optimizer (ECO) asset price model identifies signatures in price data indicating potential crashes or rallies and estimates the magnitudes, the probabilities, and the timing of expected moves.

In the examples below, various predictions for several assets are highlighted in the table. We track the forward-tested results of these predictions by using the ‘hedge’ column to weight each asset return. Note that some assets can be levered up to 2X.

In addition to the assets shown here, predictions/trading signals can be calculated on a variety of individual or index returns of equities, fixed income, commodities, or currencies over various periodicities.

Wherever one invests, our timing tools have shown benefits across a wide variety of assets.

TO SUBSCRIBE, please contact kreuser@riskontroller.com or robert@bifrostquestcapital.com. For ongoing developments, please fill in the sign-up boxes above.

ECO Bubble Predictions

- Gold – Gold continued its upward trajectory in the past week; ECO metrics show gold staying in a crash state; expected return and return no correction stay positive — maintain buy.

- JETS ETF – Airline ETF records a sizable loss in the latest week and loses out to the broader stock market; stays in crash state; expected return and return no correction both drop — maintain buy.

- Oil – Records another big positive weekly move; expected return and return no crash improve — upgrade to hold.

- USLargeCapGrowth – Small move down for the week but beats the broader market; outperforms value stocks; stays in crash mode; expected return and return no correction slip — maintain buy.

- USSmallCapValue – Sizable drop for the week but beats its small cap growth counterpart; little change in metrics — maintain buy.

- RealEstate ETF – Moves down for week as interest sensitive sectors lose; stays in crash state; rlittle change in metrics — maintain buy.

- TSLA – Volatility persists and records another big drop for the week; YTD underperformance persists; stays in rally state; expected return and return no correction stay negative — maintain sell.

- USUnvGradeBond — Big loss for the week and gets beaten by equities again; little change in metrics — maintain buy.

- Technology ETF – Down for the week and in line with the broader market but loses to its large growth style cohort; return no correction and expected return stay positive — maintain buy.

- HealthCare ETF – Records a large loss for the week and loses out to the broader market; maintains crash state; expected return and return no correction move down — maintain buy.

- Bitcoin – Negative return for the one week period as virtual currencies exhibit renewed volatility; maintains crash state; expected return and return no correction stay positive — maintain buy.

The simulated performance of this list is tracked here. For more details see ECO Overview, Notes, and Details

“WEBSITE AND THE INFORMATION CONTAINED HEREIN IS NOT INTENDED TO BE A SOURCE OF ADVICE OR CREDIT ANALYSIS WITH RESPECT TO THE MATERIAL PRESENTED, AND THE INFORMATION AND/OR DOCUMENTS CONTAINED IN THIS WEBSITE DO NOT CONSTITUTE INVESTMENT ADVICE.”

To download historical ECO scores or more information, contact kreuser@riskontroller.com.

ECO scores are an important input in the AugurMax investment process. A powerful, cutting edge asset allocation engine is created when combining ECO scores with the RisKontroller optimizer.