We go way beyond MV and MPT!

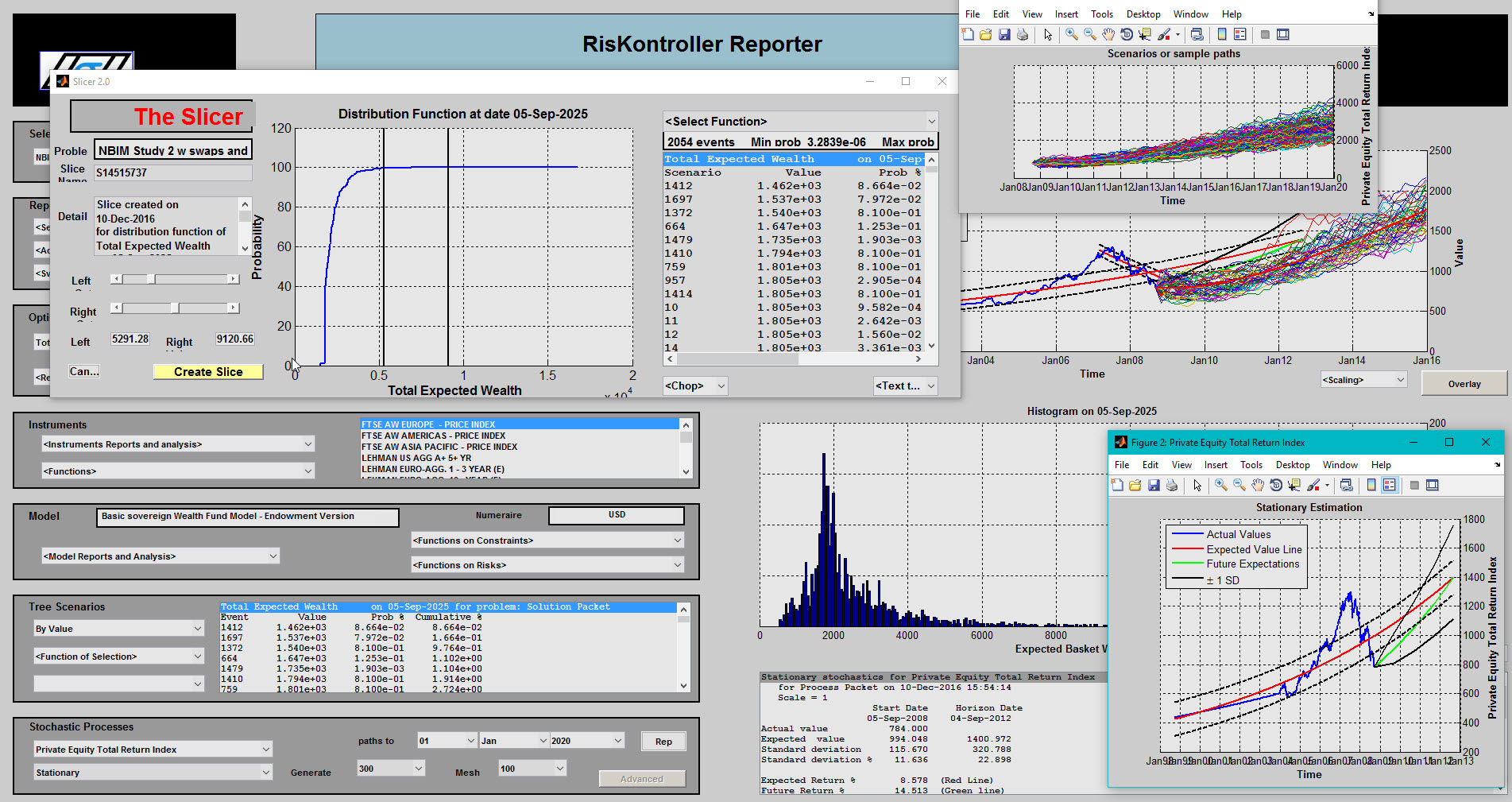

Our flagship product, RisKontroller

RisKontroller technology transferring information into knowledge, knowledge into wisdom, and wisdom into action!

Why is it unique

- Focus on long-term strategic issues.

- Integrating assets, liabilities, derivatives, alternatives, cash flows, etc.

- Corrects failures of risk management systems during the financial crisis.

- Estimates changing stochastics, correlations, etc.

- Extremely flexible and open models.

- Implements multiple objectives.

- Implements multiple goals.

- Integrates macroeconomics and finance.

- Hedges against bubbles, crashes, regime changes, etc.

- Risk constraints are applied only to the downside.

- Dynamic uncertainty structure generated using history, theories, implied prices, expert views, behaviors, sentiment, etc.

- Easily translates “executive speak” into analytics.

- Framework tested in international financial institutions.

- Handles several risk constraints over time or for shaping distributions.

- Framework is stochastic and dynamic – necessary for long-term strategic investments

- Combines long-term predictability with short-term volatile movements (momentum plus mean-reversion).

- Extremely powerful optimizers and open models.

- Provide insight into solutions via visualization.

- And more.

Providing Insight For

- Strategic benchmarks and dynamic benchmarks.

- Asset composition.

- Relative values.

- Risk-adjusted values.

- Attribution. Scenario/tree analysis.

- Tests of good solutions.

- State-prices.

- Full outcome densities.

- Graphs, tables, charts.

- Dynamic rebalancing.