AugurMax Asset Allocation Changes 2026-01-31

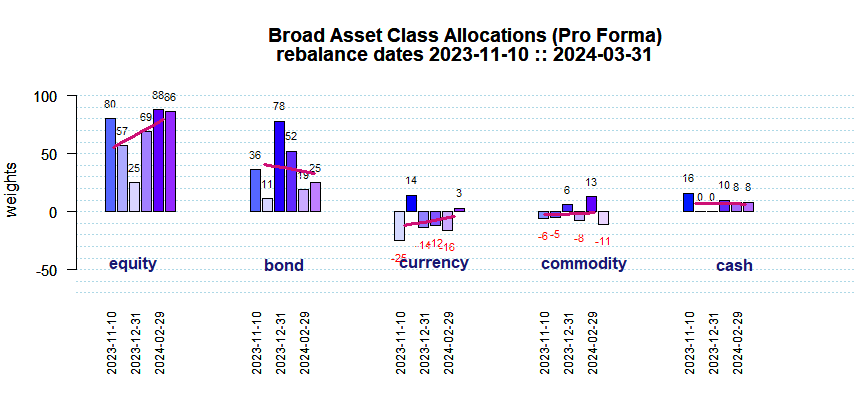

Equity exposure was raised at the end of January after stocks around the globe rose. Paradoxically, the VIX moved up for the month as stocks rose. Stocks outperformed the other broad asset classes except commodities (Oil and especially NatGas surged). As stock exposures were increased, their 2026-01-31 level pushes them above their longer-term average. The cut to Bonds marked a sizable shift in recent high bond allocations and they are now below their long-term average weighting. The prescribed Currency exposure kicked up for a third month — this positive Currency exposure suggests the dollar will underperform foreign currencies. Commodity exposure is negative and below its longer term weighting.

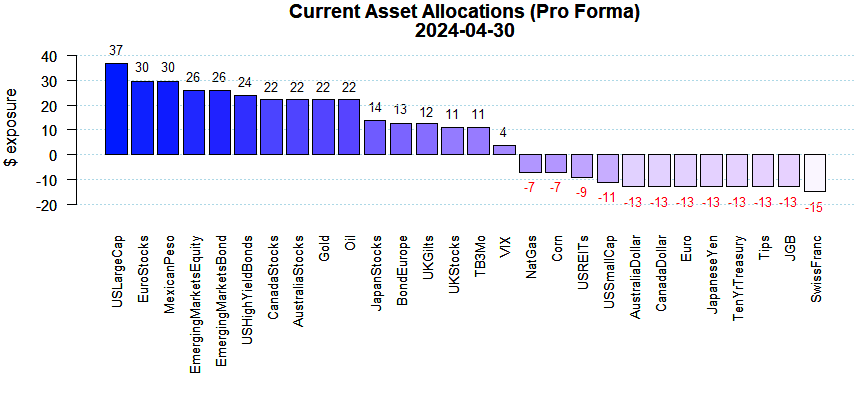

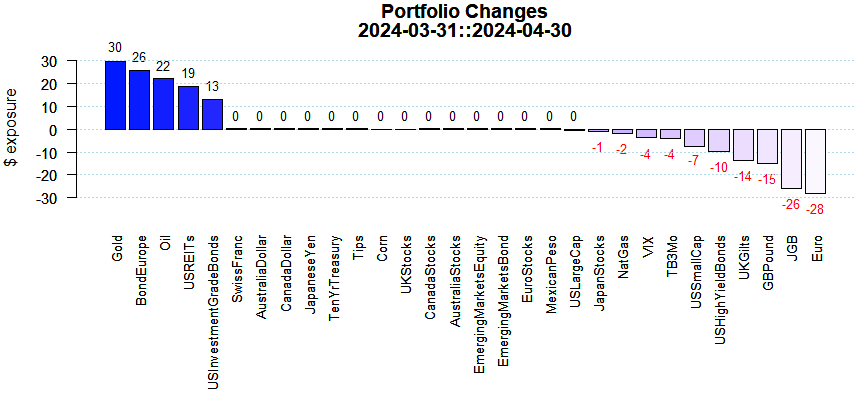

Equity additions were highly selective as Emerging Markets, Euroland, US Small Caps, and Australia received allocations. US Large Caps and Japan were cut the most. The VIX exposure was basically unchanged and its (small) long exposure essentially represents a hedge on the US stock market. Interest sensitive US REITs were pushed down modestly and continues to represent a short.

A few Bond asset classes had big subtractions including US Ten Year, US Tips, and UK Gilts. Europe Bonds were added to the most. Cash exposure moved down a tiny bit.

All commodities were cut especially Oil.

Currency returns were up in January. The Swiss Franc and the Aussie Dollar were added to the most as the Canadian Dollar was sliced.

While domestic stock returns gained ground in January, investors renewed their concerns over geopolitical strife, the crypto crash, and precious metal volatility. Value stocks outperformed growth stocks as energy and staples rallied. Bonds were up around the globe even though the FED paused rate cuts. US Treasuries underperformed US Tips hinting that we’re not out of the woods with inflation (see breakeven inflation rates). With US Large Caps more than 41% above their April 2025 lows (see worst drawdowns) hedge funds have fared well. The prescribed changes herein are largely influenced by our ECO methodology. Performance results (on a stand-alone basis) for assets like Gold and others using our ECO metrics are shown here.