Bubbles, crashes, rallies, and corrections

Fundamental, cyclical, and emotional factors influence financial markets and can be observed in market prices. Over various time frames, prices can exhibit non-random behavior such as trending, mean-reversion, or bubbles. These price patterns arise in all global markets and can be exploited profitably given adequate liquidity.

But price patterns are transitory and poorly understood by most discretionary investors. The Efficient Crashes Optimizer (ECO) asset price model identifies signatures in price data indicating potential crashes or rallies and estimates the magnitudes, the probabilities, and the timing of expected moves.

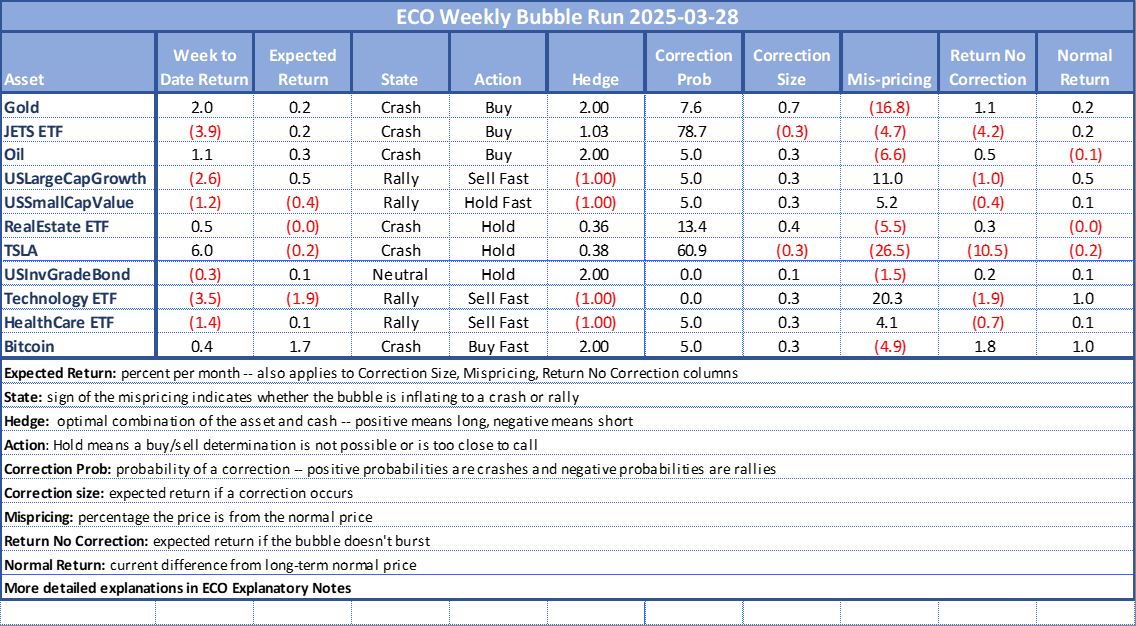

In the examples below, various predictions for several assets are highlighted in the table. We track the forward-tested results of these predictions by using the ‘hedge’ column to weight each asset return. Note that some assets can be levered up to 2X.

In addition to the assets shown here, predictions/trading signals can be calculated on a variety of individual or index returns of equities, fixed income, commodities, or currencies over various periodicities.

Wherever one invests, our timing tools have shown benefits across a wide variety of assets.

TO SUBSCRIBE, please contact kreuser@riskontroller.com or robert@bifrostquestcapital.com. For ongoing developments, please fill in the sign-up boxes above.

ECO Bubble Predictions

- Gold – Gold was down in the past week accompanying the bond downdraft; ECO metrics show gold staying in a (potential) crash state; return no correction goes negative — maintain hold.

- JETS ETF – Airline ETF posted a negative return in the past week continuing its recent weekly losses; ECO metrics show JETS staying in crash state; return no correction drops further into the red — maintain sell.

- Oil – Down for a second week but strong YTD gain holds; moves up to neutral state; expected return rises but return no correction slips — maintain hold.

- USLargeCapGrowth – Big drop in the prior week as strong equity market rotation appears; underperforms the broader stock market in a rare move and loses to value stocks; stays in crash mode; little change in metrics — maintain buy.

- USSmallCapValue – Posts a huge gain for the week and pummels the broader market; expected return and return no correction improve — upgrade to buy.

- RealEstate ETF – Continues a series of steady gains in the past week; stays in crash state; expected return continues its ascent — upgrade to buy.

- TSLA — Down for second week; stays in crash state; both expected return and return no correction slip — maintain buy.

- USUnvGradeBond — Posts a negative weekly return; expected return and return no correction both positive — maintain buy.

- Technology ETF – Pummeled in the past week and underperforms its large growth cohort; stays in crash state; little change in metrics — maintain buy.

- HealthCare ETF – Down for the week but beats the market; YTD underperformance persists; maintains crash state; return no crash goes positive — maintain buy.

- Bitcoin – Records a double digit gain for the week; maintains crash state; both return no correction jumps — upgrade to buy.

The simulated performance of this list is tracked here. For more details see ECO Overview, Notes, and Details

“WEBSITE AND THE INFORMATION CONTAINED HEREIN IS NOT INTENDED TO BE A SOURCE OF ADVICE OR CREDIT ANALYSIS WITH RESPECT TO THE MATERIAL PRESENTED, AND THE INFORMATION AND/OR DOCUMENTS CONTAINED IN THIS WEBSITE DO NOT CONSTITUTE INVESTMENT ADVICE.”

To download historical ECO scores or more information, contact kreuser@riskontroller.com.

ECO scores are an important input in the AugurMax investment process. A powerful, cutting edge asset allocation engine is created when combining ECO scores with the RisKontroller optimizer.