AugurMax Asset Allocation Changes 2025-06-30

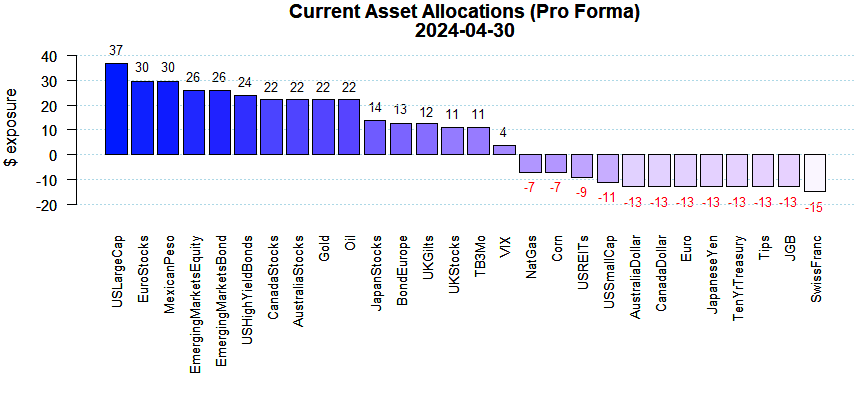

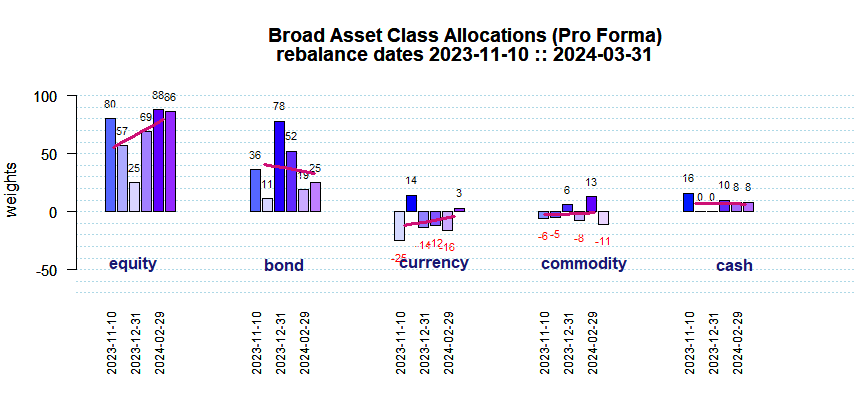

Equity exposure was raised at the end of June as stocks continued to rally off their April 8th lows and the threat to the global economy from geopolitical strife and tariff wars seemed to subside. During the month, stock moves were marked by a sharp rise in volatility but volatility measures backed off by month end. Stocks outperformed the other broad asset classes especially commodities (which experienced a dramatic roller coaster ride). Stock exposures were bumped up and re-allocations at 2025-06-30 brought them above their longer term average weighting. Bond exposures fell and are somewhat below their long-term average weighting. The prescribed Currency exposure also moved down and is now closer to its normal allocation. Despite the move down, a positive Currency exposure suggests the dollar will continue to underperform foreign currencies. Commodity exposure is essentially neutral.

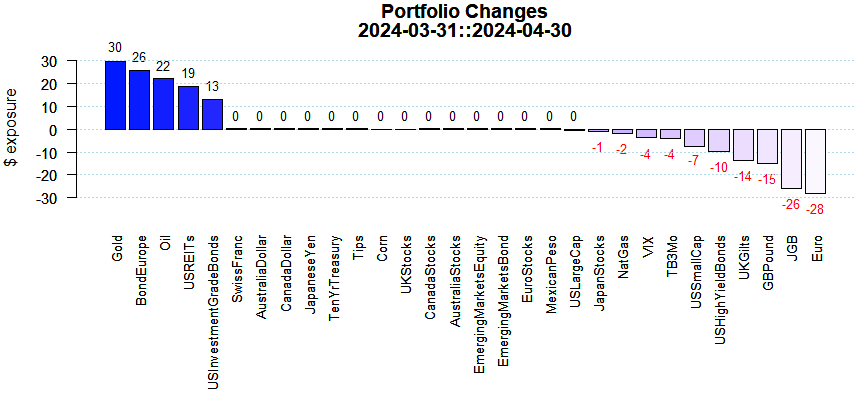

Equity additions were highly selective with Emerging Markets, Canada, and Japan receiving the lion’s share. The VIX exposure was unchanged and this long exposure represents an inverse US stock market bet. Interest sensitive US REITs were raised modestly.

Bond exposures were pushed down in a few bond asset classes with subtractions to US High Yield, US Treasuries, and the UK. Emerging Market Bonds and US Investment Grade were raised the most. Cash exposure dropped.

Within commodities, Oil was raised while NatGas moved down marginally.

Currency returns were up across the board in May. A lower dollar makes foreign goods more expensive so for the US consumer, any price increases from new tariffs will be exacerbated by a lower dollar. Most currency exposures were cut with the Yen, GB Pound, and the Euro moving down the most.

While domestic stock returns gained ground big time in June, uncertainties from the Trump regime’s policy actions/threats remained. Growth stocks continued to beat value stocks, as key tech bellwethers reported robust earnings. Bonds were mostly up around the globe as some inflation measures abated but concerns about global growth continued. US Treasuries beat US Tips hinting at lower inflation fears (see breakeven inflation rates). While US Large Caps are more than 25% above their April 2025 lows (see worst drawdowns) many institutional investors have not participated in the rebound as concerns over budget deficits, valuations, and repercussions from US tariff threats persist. The prescribed changes are largely influenced by our ECO methodology. Performance results (on a stand-alone basis) for assets like Gold and others using our ECO metrics are shown here.