Skip to content

We go way beyond MV and MPT!

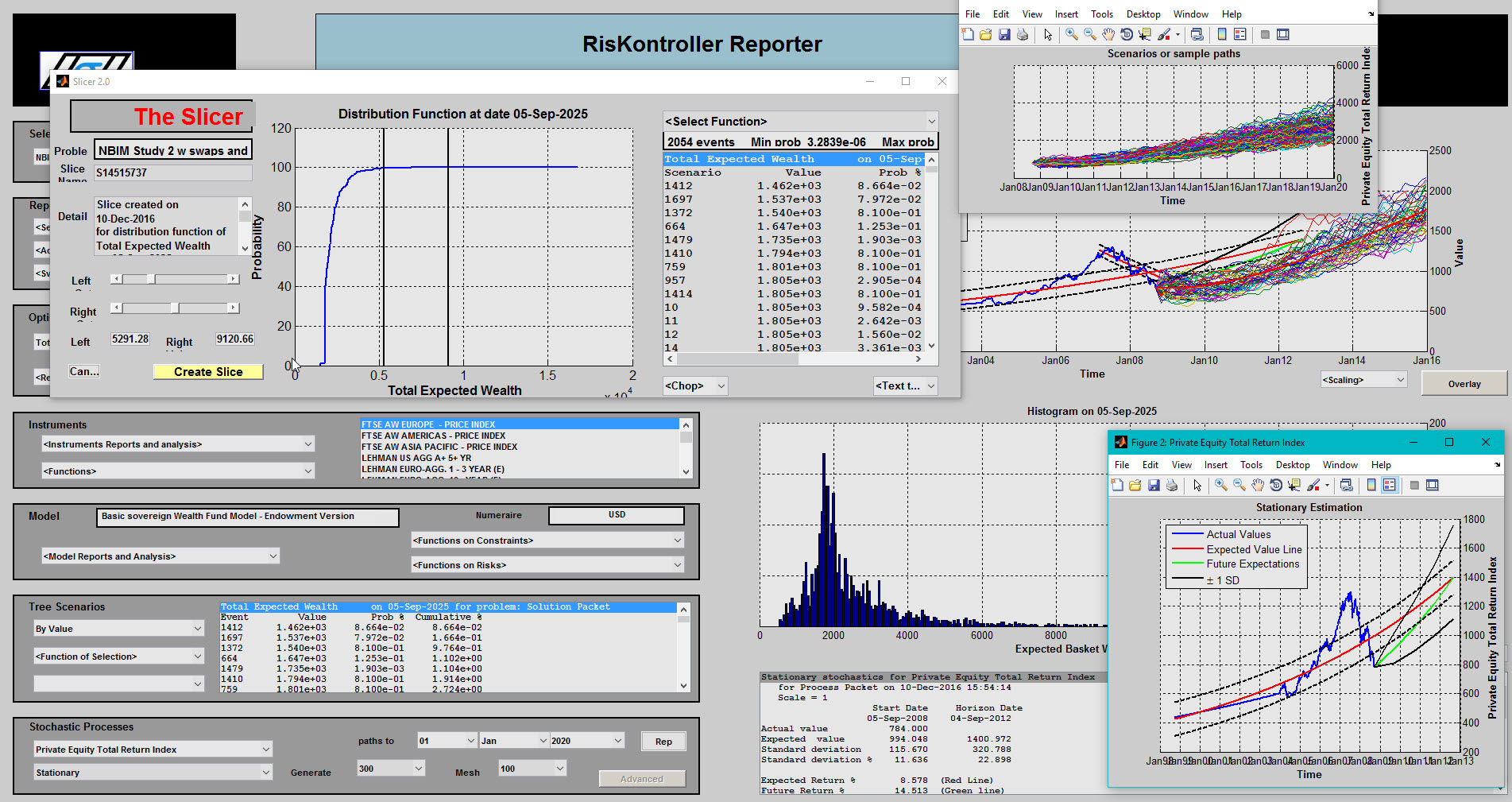

Our flagship product, RisKontroller

RisKontroller technology transferring information into knowledge, knowledge into wisdom, and wisdom into action!

Why is it unique

- Focus on long-term strategic issues.

- Integrating assets, liabilities, derivatives, alternatives, cash flows, etc.

- Corrects failures of risk management systems during the financial crisis.

- Estimates changing stochastics, correlations, etc.

- Extremely flexible and open models.

- Implements multiple objectives.

- Implements multiple goals.

- Integrates macroeconomics and finance.

- Hedges against bubbles, crashes, regime changes, etc.

- Risk constraints are applied only to the downside.

- Dynamic uncertainty structure generated using history, theories, implied prices, expert views, behaviors, sentiment, etc.

- Easily translates “executive speak” into analytics.

- Framework tested in international financial institutions.

- Handles several risk constraints over time or for shaping distributions.

- Framework is stochastic and dynamic – necessary for long-term strategic investments

- Combines long-term predictability with short-term volatile movements (momentum plus mean-reversion).

- Extremely powerful optimizers and open models.

- Provide insight into solutions via visualization.

- And more.

Providing Insight For

- Strategic benchmarks and dynamic benchmarks.

- Asset composition.

- Relative values.

- Risk-adjusted values.

- Attribution. Scenario/tree analysis.

- Tests of good solutions.

- State-prices.

- Full outcome densities.

- Graphs, tables, charts.

- Dynamic rebalancing.